Manual processes are silently strangling the growth potential of accounting firms across the UK. While these traditional methods once served smaller practices well, they become increasingly problematic as firms scale and client demands evolve. According to recent industry studies, firms still relying heavily on manual processes experience 40% slower growth rates compared to their digitally-enabled competitors.

The reality is harsh but simple: what got your firm to where it is today won't necessarily take you where you want to go tomorrow. Manual accounting processes create bottlenecks that prevent firms from focusing on high-value advisory services, limit scalability, and ultimately cap your revenue potential.

Here are seven critical warning signs that your firm's manual processes are holding you back: and practical solutions to transform your operations for sustainable growth.

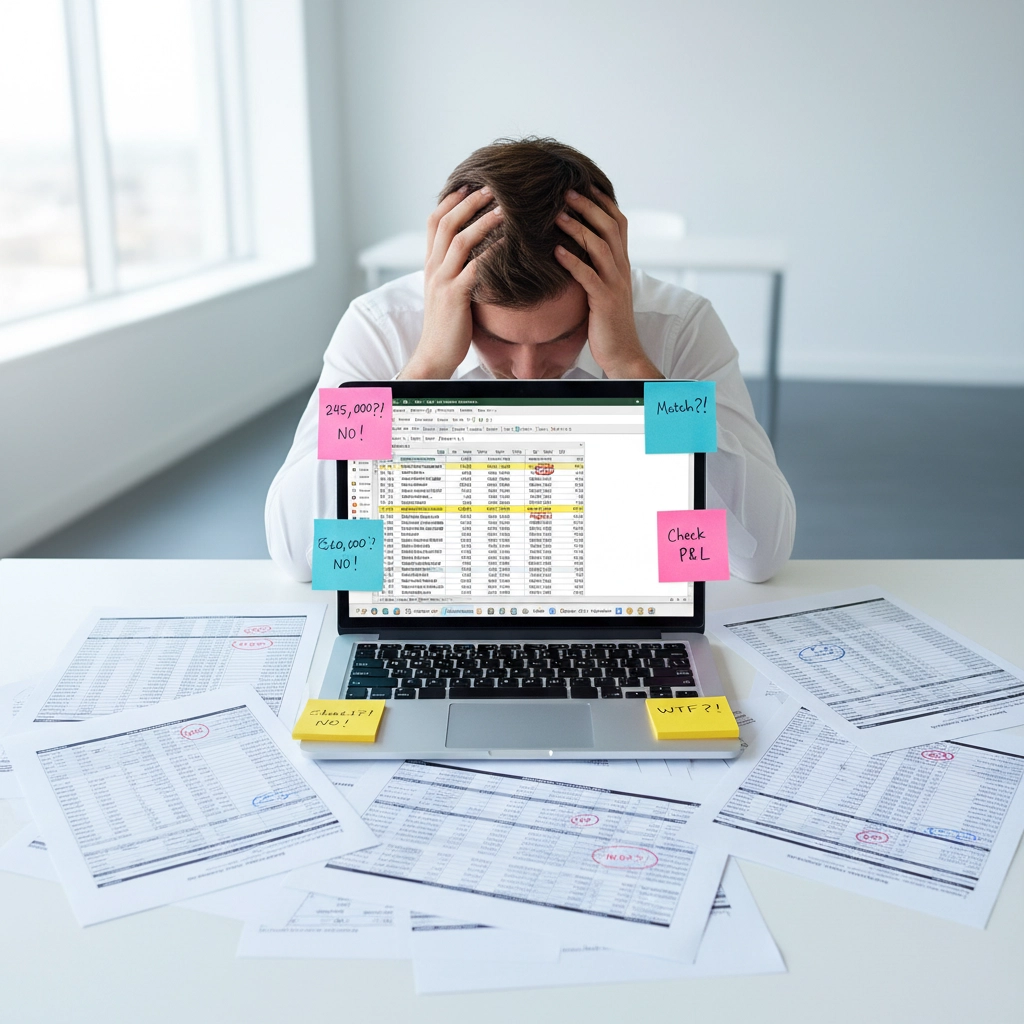

1. Your Team Lives in "Spreadsheet Purgatory"

The Problem: Your staff spends significant time creating, updating, and reconciling multiple versions of spreadsheets across different clients and projects. Email chains with "Final_v2_REVISED_FINAL.xlsx" attachments have become the norm, and your team regularly works with outdated information because someone forgot to update the "master" spreadsheet.

This scattered approach creates confusion, version control nightmares, and leaves your team constantly second-guessing whether they're working with current data. Ernst & Young research shows that firms using primarily spreadsheet-based systems experience 65% more data errors compared to those using integrated accounting platforms.

The Solution: Implement a centralised database system with real-time collaboration features. Cloud-based accounting platforms eliminate version control issues and provide a single source of truth for all client data. This transformation typically results in 90% fewer data discrepancies and saves each team member approximately 8-12 hours per week previously spent on spreadsheet management.

Consider platforms that offer automated data synchronisation, real-time updates, and role-based access controls to ensure your team always works with current, accurate information.

2. Simple Approvals Take Days, Not Hours

The Problem: Expense approvals, time-off requests, and purchase authorisations require multiple touchpoints, reminder emails, and often physical paperwork circulation. What should be a 10-minute process stretches into multi-day delays that frustrate staff and slow business operations.

These approval bottlenecks particularly impact client work, where delayed expense approvals can hold up project completion and billing processes.

The Solution: Digital workflow automation transforms approval processes from days to minutes. Automated routing ensures requests reach the right approvers immediately, while built-in escalation procedures prevent requests from getting lost in email inboxes.

Firms implementing digital approval workflows report 78% faster processing times and significantly improved staff satisfaction scores. The audit trails created by these systems also provide valuable insights into bottlenecks and help optimise future processes.

3. Manual Data Entry Consumes Your Most Valuable Resource: Time

The Problem: Your qualified accountants and bookkeepers spend hours manually entering payroll data, reconciling bank statements, and processing invoices. This represents a massive opportunity cost: every hour spent on data entry is an hour not spent on value-added advisory services that command higher fees.

Research indicates that each manually processed invoice costs UK accounting firms an average of £15-20 in labour costs, while automated processing reduces this to under £2 per invoice.

The Solution: Implement accounting automation software with optical character recognition (OCR) and bank feed integration. These technologies automatically capture data from invoices, receipts, and bank statements, reducing manual entry by up to 85%.

The time savings are substantial: firms typically recover 15-25 hours per week per team member, which can be redirected toward client advisory work that generates 3-4 times higher hourly rates than basic bookkeeping tasks.

4. You're Flying Blind Without Real-Time Financial Insights

The Problem: Manual processes mean your financial reporting is always retrospective, typically updated only through monthly closures. This delay prevents proactive decision-making and leaves you reacting to problems rather than anticipating opportunities.

Without real-time visibility into cash flow, client profitability, and operational metrics, you're essentially managing your firm using outdated information in a fast-moving business environment.

The Solution: Transition to accounting platforms that provide real-time dashboards and automated reporting. Businesses with real-time financial visibility make decisions 40% faster and identify revenue opportunities 60% sooner than those relying on monthly reports.

Modern accounting systems can provide instant insights into key performance indicators, client profitability analysis, and cash flow projections, enabling more strategic firm management.

5. Rising Error Rates Are Creating Compliance Risks

The Problem: Manual data entry inevitably leads to human errors: transposed numbers, missed entries, incorrect calculations. These mistakes compound over time, creating financial discrepancies that can result in costly penalties, compliance issues, and damaged client relationships.

UK accounting firms report that manual processes contribute to 73% of compliance-related errors, with correction costs averaging £2,500-5,000 per significant mistake when factoring in time, penalties, and potential client loss.

The Solution: Automation eliminates most human errors by removing manual data entry points and implementing built-in validation rules. Automated systems provide consistent accuracy and create comprehensive audit trails that simplify compliance documentation.

Firms implementing accounting automation report 91% fewer processing errors and significantly reduced compliance risks, while also improving client confidence in data accuracy.

6. Your Current Software Can't Scale With Your Ambitions

The Problem: Entry-level accounting software that worked perfectly for 10 clients becomes a limitation when managing 50+ clients with diverse needs. Your current system struggles with increased transaction volumes, complex project tracking, or advanced reporting requirements.

This software limitation forces your team to work around system constraints rather than leveraging technology to enhance productivity and service delivery.

The Solution: Invest in scalable, cloud-based accounting platforms designed for growing practices. These systems adapt to increased data volumes, offer advanced features like multi-entity management and customised reporting, and integrate with other business systems.

Firms upgrading to scalable platforms report 45% improved operational efficiency and the ability to take on 30-50% more clients without proportionally increasing staff costs.

7. Staff Burnout Is Driving Talent Away

The Problem: When your qualified professionals spend most of their time on repetitive, manual tasks, job satisfaction plummets. High-value team members leave because they're not engaged in meaningful work that utilises their skills and expertise.

The UK accounting sector experiences 23% higher turnover rates in firms heavily dependent on manual processes compared to digitally-enabled practices. Constant recruitment and training costs can consume 15-20% of annual revenue.

The Solution: Streamline operations by eliminating manual processes, allowing your team to focus on analysis, advisory services, and strategic client work. When staff engage in intellectually challenging work rather than repetitive data entry, job satisfaction increases dramatically.

Firms successfully reducing manual work report 67% better staff retention rates and find it significantly easier to attract top talent who want to work with modern tools and focus on high-value activities.

The Path Forward: Strategic Digital Transformation

Addressing these seven warning signs requires a systematic approach to digital transformation. Start by conducting a process audit to identify your biggest bottlenecks, then prioritise improvements based on potential time savings and error reduction.

The investment in modern accounting systems typically pays for itself within 6-12 months through improved efficiency, reduced errors, and enhanced capacity for higher-value work. More importantly, this transformation positions your firm for sustainable growth and competitive advantage in an increasingly digital marketplace.

Remember: your competitors are already making these changes. The question isn't whether to modernise your processes, but how quickly you can implement improvements to maintain your market position and serve your clients more effectively.

Ready to transform your firm's operations? The CollabHub specialises in helping UK accounting practices streamline their processes and implement scalable systems for sustainable growth.

Connect with us:

About the Author

Mohammad Aamish Aaftab is the Founder of The CollabHub, a consulting and back-office support firm helping UK accounting and bookkeeping practices streamline operations, strengthen client delivery, and scale sustainably.

With years of experience working with global firms across the U.S., U.K., and U.A.E., Aamish has built a reputation for turning inefficient workflows into efficient, scalable systems. His focus lies in helping firms operate smarter : not harder : by designing backend processes that reduce overwhelm, save time, and improve profit margins.

Aamish combines his background in financial planning, business operations, and process consulting to help accounting leaders regain clarity, consistency, and control in their practice : so they can focus on what truly matters: their clients and their long-term growth.